Prospecting From Your Office Chair!

I am often asked, “how do I sell high-limit or excess disability insurance?”

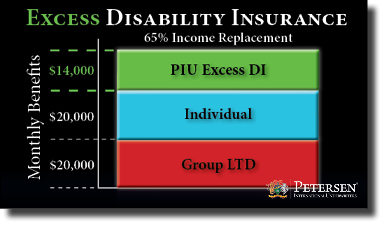

The first step is identifying a prospect. In the world of excess DI coverage, you need to be aware of how much disability insurance a person should have versus what they are able to get from the standard markets. In general, a person should have no less than 65% of their total income protected! That number comes from many sources within the insurance industry as well as other financial sectors.

A prospect whose annual income is about $150,000 probably can get at, or very close to, the 2/3 coverage needed from domestic sources. The traditional insurance markets do a fantastic job at covering the majority of income protection prospects. However, there are many clients we come across whose incomes are higher than $150,000.

An interesting thing happens within the issue and participation limits of traditional DI carriers. As a person’s income goes up, the percentage of income carriers will cover goes down! If you look at the issue and participation limits of most insurance companies, you will find a person with an annual income of $600,000 to be lucky if they can get even as much as 40% of their earnings covered by a single policy. And 40% is a far cry from 65%.

What to do?

Now this is where the excess disability programs come into play. Excess DI can be layered over any group and/or individual disability insurance plans to bring income protection levels up to that important 65% level. Notice, I did not mention a dollar amount. The percentage of income is the important factor to note, not the specific dollar amount.

So now that we have identified who needs excess disability coverage, how do we find these clients? Any savvy businessperson will tell you, the best customers (and the most cost effective for sales opportunities) are those clients already doing business with you! Think of your current clients. Or better yet, open your files right now and look at your clients’ coverage. Do any of them make more than $150,000 a year? If so, take a look at their current disability benefits. If you add those benefits up and find that they cover less than 65% of the client’s annual income, you automatically have an existing client that is now a prospective customer for additional income protection!

How was that? You didn’t even have to leave your office to find new prospects for additional DI coverage. Now here is an exciting twist. Petersen International’s Simplified Issue Disability Program makes the prospecting and the processing even easier than you think. Has your client been approved for disability coverage with a traditional carrier in the past 90 days? If so, we can probably offer that client up to $20,000 of monthly benefit on top of existing DI coverage with no additional underwriting. It’s that easy! Contact our DI department at (800) 345-8816 for additional information on how to more effectively sell high-limit and excess disability insura