Business Uses of Disability Insurance – Part I – Wage & Salary Continuation

Wage/Salary Continuation Plans (a.k.a. qualified sick pay plans) Part I

WARNING!

Getting sick or hurt can cost a person his/her job!

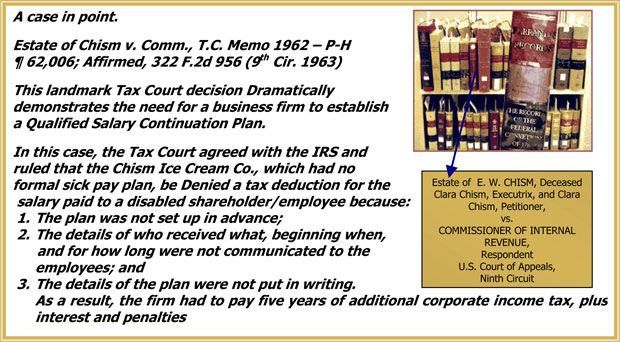

Salary or Wages paid to a disabled employee who is disabled and therefore not currently performing services for the employer are not deductible as a business expense – – – – unless the firm had a Qualified Salary Continuation Plan in force prior to the disablement of the employee.

A person not covered by a Qualified Salary Continuation Plan before disability begins is considered an EX-EMPLOYEE. Money paid to an EXEMPLOYEE is not considered salary or wages and therefore is not a deductible business expense to the firm. The money received by the EX-EMPLOYEE is described by the Federal Tax Court as “Ad Hoc Payments”, or payment without a plan and are therefore subject to taxation as gifts or dividends.

And the Estate of the deceased employee was assessed back taxes and interest on the payments received from the firm. It was reported that the combined collections by the IRS from the Estate and the Chism Company nearly exceeded the money paid to the employee during his five years of disability.