Everyday Solutions for Usual and Unusual Insurance Roadblocks

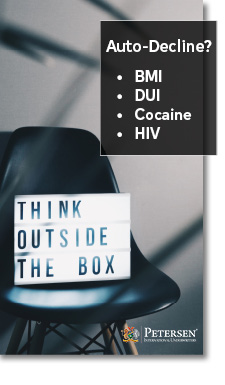

Life and disability insurance sales are often hampered by a commonly occurring problem – impaired risk. “My client takes meds for depression. My client has a leaky heart valve. My client has been arrested for DUI. My client is too heavy for his/her height. My client was recently diagnosed with Parkinson’s. My client has HIV. My client attended a bachelor party in Las Vegas and tried Cocaine just once…several days before providing a urine sample for an insurance exam.”

That last one may sound oddly specific, but you would be surprised how often we hear of these and similar issues, and all of them are usually grounds for insurance policy declinations from traditional DI and life carriers. Petersen International is privileged to be different. We realize your clients are human and that their bodies and minds fallible. Naturally, a percentage of your clientele are bound to suffer from significant health issues, substance dependence or psychiatric disorders like many of their fellow Americans.

Utilizing more lenient and flexible underwriting guidelines than traditional U.S. markets, we are able to provide insurance solutions with special ratings and exclusions for substandard health histories, drug and alcohol abuses and mental and psychiatric disorders. Prospects facing those roadblocks are readily able to qualify for the coverage they require, financially safeguarding their families and businesses. Petersen International is the proper solution, providing your clients with invaluable asset and income protection.

And unlike most domestic life and health companies, our underwriters do not subscribe to or report client information to the Medical Information Bureau (MIB). Our usual application and underwriting practices refrain from creating sordid medical history trails, allowing your clients the utmost privacy and underwriting fairness. We aim to judge risk upon information relevant to the specific insurance product and prospect in question, and to make the entire application and underwriting process as smooth and unobtrusive as possible.

Don’t let commonplace underwriting barriers keep your clients from seeking the financial security they so deserve. Reach out for assistance today at (800)345-8816.