Impaired-Risk Term Insurance

One of the most common inquiries we receive from financial advisors and insurance brokers is with regards to substandard-risk life insurance. There are countless clients and agents out there searching for a substantial-benefit outlet to no avail. As is commonly known, Petersen International readily has disability insurance programs available for prospects that aren’t insurable in the traditional markets due to health, build, criminal history, alcohol/substance dependence, occupation hazards and other impaired-risk factors. Yet, less is known about Petersen’s growing portfolio of term insurances that provide high-limit death benefits on impaired-risk cases.

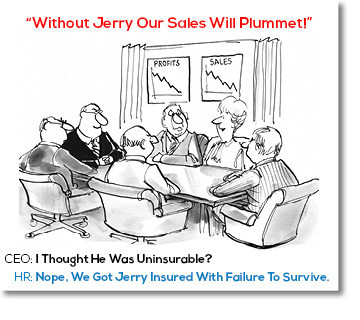

I would like to introduce you to Failure to Survive insurance. You may be wondering what it is, why you should care and how it can fit into your business. Failure to Survive (FTS) insurance is a brilliant and forward-thinking series of products developed for use in the U.S. market. Its many attributes have drawn a growing following of American brokers as of late, and it will prove to be very useful to your business clients. FTS coverage will save many of the cases you stand to lose for one reason or another.

The basic FTS product is similar in format to term insurance for third-party applications. Its main purpose is to address key person, buy/sell, contract guarantee or business loan situations where there is a financial obligation to indemnify a business contract upon the death of an individual (usually the business owner or a key employee) with insurance. It cannot be used as an alternative to personal-benefit life insurance, but is commonly employed to cover divorce decrees, surrogacy agreements and alimony/child support court orders.

Medically sub-standard cases find easy solutions among the FTS product line as the underwriting guidelines are more flexible than those of traditional carriers, allowing for medical exclusions and coverage for persons with infirmities like cardiac, body mass and diabetes issues. It’s also optimal for prospects with drug, alcohol and mental/nervous concerns.

The magic of the FTS product is that it can be underwritten quickly. The average turnaround time from receipt of application to the binding of coverage is usually no more than several business days. Underwriters offer simplified issuance of the coverage without requirements like intrusive medical exams, blood draws and urinalyses.

The fast underwriting period allows policy owners to meet the strict and time-sensitive deadlines mandated by lending institutions on loan agreements. An FTS policy can also be extremely useful when the underwriting of a traditional term product is holding-up a business deal relying upon the insurance for a corporate buy/sell or investment agreement.

Failure to Survive insurance has many impactful applications in the market today, and can help you save cases that you otherwise thought were dead in the water or at the very least faltering. FTS coverage is another great everyday solution for the pervasive complications encountered in the U.S. market.

Call Petersen International Underwriters at (800)345-8816 for a more in-depth introduction to Failure to Survive insurance and its remarkable capabilities.