Minimizing Corporate Risk with BOE Disability Insurance

To run a successful business in the United States, the owner of a company must bring-in enough revenue to sustain usual expenses including rent, mortgages, utilities, loans and the payroll of employees, in turn making a profit to cover his or her own personal income and lifestyle needs. And we all know the corporate world can be fickle. Unanticipated business shortfalls like recessions, changing markets, and devolving client bases can play havoc with a company no matter if it is a startup or it has been profitable for decades. But the greatest risk to a business is the loss of the owner, that figurehead who manages the day-to-day, pays the bills every month and drives profitability while maintaining balance.

To run a successful business in the United States, the owner of a company must bring-in enough revenue to sustain usual expenses including rent, mortgages, utilities, loans and the payroll of employees, in turn making a profit to cover his or her own personal income and lifestyle needs. And we all know the corporate world can be fickle. Unanticipated business shortfalls like recessions, changing markets, and devolving client bases can play havoc with a company no matter if it is a startup or it has been profitable for decades. But the greatest risk to a business is the loss of the owner, that figurehead who manages the day-to-day, pays the bills every month and drives profitability while maintaining balance.

The unexpected, premature death of a business owner will usually cause a cease in operations or trigger the sale of the business or the pre-negotiated buy-out by partners or employees. But instead contemplate, not the death, but the unforeseen partial or total disablement of a business owner. Just because someone can’t work and run a company doesn’t mean that the corporate bills are halted. Business overhead is costly and continuous as long as the lights are on and an office remains open.

A business needs short-term financial assistance to make ends meet when the owner is sick or injured for more than 30 days. Business overhead expense (BOE) insurance is the most decisive financial solution for such a worrisome situation as the partial or total disablement of the owner. The insurance policy consists of “own-occupation” disability coverage designed to indemnify dollar for dollar the monthly overhead costs of small to medium-sized companies with one or more owners, virtually no matter the corporate structure.

BOE coverage is readily available from most traditional U.S. carriers, and employment of such a product allows for business owners to use their personal disability benefits for originally-intended purposes like family protection and lifestyle continuation. Instead of being forced to allocate personal DI benefits to help fund overhead costs of a company, a smart employer will purchase enough BOE insurance to sufficiently cover those monthly business costs.

Benefit options vary among insurers with ranges in elimination/waiting periods from 30 days to 180 days and ranges in benefit periods from 6 months to 24 months. And most BOE products offer optional riders for residual disability benefits.

Frequently, consumers shopping the disability market will fail to find any or sufficient levels of BOE coverage available to them due to a variety of factors including provider participation levels, age and occupation restrictions as well as impaired health limitations. Petersen International’s BOE program is the solution for all of those issues including excess, high-limit BOE coverage.

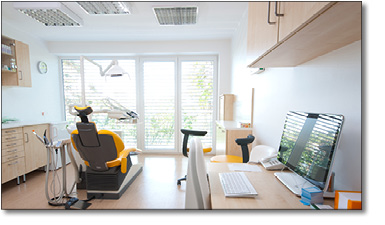

Petersen’s BOE product is utilized by business owners from many industries throughout the country, but most specifically by those in the medical and dental fields whose practices require staff and equipment costs that reach hundreds of thousands of dollars every month.

Don’t let your clients waste their personal DI benefits on indemnifying their companies’ monthly liabilities. Prescribe BOE insurance from one or two sources in sufficient amounts to cover 100% of their firms’ overhead costs, smartly minimizing corporate risk.