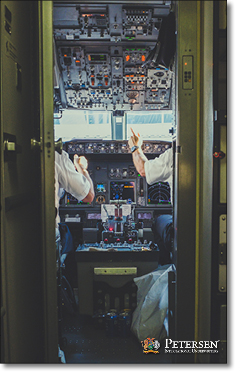

Risk Spotlight – Real Life Case

A 46-year-old commercial airline pilot felt rightfully underinsured with his only form of personal income protection being a group long-term disability plan sponsored by his employer. With an annual income of $350,000, this top-tier aviator with significant seniority was unfortunately capped by the airlines’ LTD policy at 50% of his income. It was hardly enough protection to provide for his wife and their young children had he become disabled or lost his flight medical certificate and been grounded by the FAA.

On his behalf, an insurance agent sought out additional coverage through traditional carriers to no avail, but eventually inquired with Petersen International to tap into some alternative specialty markets. We were able to introduce this client to our Loss of License insurance program designed specifically for income protection of professional aviators by financially indemnifying medical certification with the FAA.

We were able to offer him $4,375 of monthly Loss of License insurance with a 180-day elimination period and an outstanding benefit period of 60 months. The PIU policy successfully brought his income protection up to the 65% of income target.

Petersen International has the solutions your aviation clients need for specialty disability and Loss of License coverage.