An Important Question

Those of us in the life/health insurance business should know that disablement is a frightening reality of life. Sudden injury and prolonged sickness can happen to anyone at any stage of their career. Yet most white-collar Americans maintain proper disability insurance on less than half of their monthly income.

Those of us in the life/health insurance business should know that disablement is a frightening reality of life. Sudden injury and prolonged sickness can happen to anyone at any stage of their career. Yet most white-collar Americans maintain proper disability insurance on less than half of their monthly income.

If you weren’t physically able to work, could you live on 50% of your income? A simple, but important question. The realistic answer is “no” or at the very least, “not very well.” A person may literally be able to survive on 50% of his/her income, but he/she will certainly struggle to make ends meet. And in no way can a person maintain a comfortable lifestyle on half of their usual earnings, especially when a family is requiring support.

The need for more income protection in this country is quite evident as we are barraged by statistics showing a very common lack of personal savings among most households. Along many U.S. industry lines, corporations will provide disability insurance through employee assistance platforms, but most physician and white-collar programs insufficiently limit benefits to a fraction of earned income, creating a great financial shortfall for high-income earners. The only appropriate answer is the prescription of more and higher limits of disability insurance throughout the market.

Securing individual DI is another obvious step, but again, traditional disability carriers frequently fall short with issue and participation limitations. If you have any clients or prospects that are making over $250,000 annually, they should be insured at least up to 65% to 75% of earnings, and their protection needs will not be met by group coverage even with the addition of a single layer of individual DI. The bundling of group and individual DI alone is usually not a sufficient solution. That is a fact.

A third layer or tier of comprehensive income protection is a must for many Americans. High-limit, excess personal disability insurance is the only way physicians, attorneys, accountants and white collar executives are going to find appropriate levels of economic safeguard.

Petersen International offers a variety of “third-tier” DI products to ensure the financial safety of your affluent and typically underinsured clientele. We can also help you address the almost certain lack of income protection among most insurance prospects. Give us a call at (800)345-8816 for more insight to the “tiered approach” to income protection.

Feeling Protected in a Foreign Land is Paramount

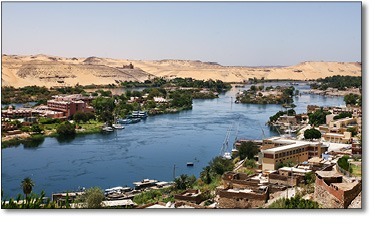

Americans travel the globe for many reasons. Some travel to Karachi to visit family. Many sail the Nile exploring ancient archeological sites. Some of us fly to Sao Paulo for business meetings. Others trek the Himalayas on eco-adventures or vacation in Kenya on safari. Some of us even work in Baghdad guarding the U.S. Embassy. We participate in these endeavors and freely visit or live in these places because we might feel a sense of adventure or nostalgia or even duty. Or we may visit these places simply because there is a welcomed paycheck involved. But those of us who travel to or work in these exotic locales may not be completely aware of how truly dangerous much of the world is.

Americans travel the globe for many reasons. Some travel to Karachi to visit family. Many sail the Nile exploring ancient archeological sites. Some of us fly to Sao Paulo for business meetings. Others trek the Himalayas on eco-adventures or vacation in Kenya on safari. Some of us even work in Baghdad guarding the U.S. Embassy. We participate in these endeavors and freely visit or live in these places because we might feel a sense of adventure or nostalgia or even duty. Or we may visit these places simply because there is a welcomed paycheck involved. But those of us who travel to or work in these exotic locales may not be completely aware of how truly dangerous much of the world is.

Precautions can be taken, but not everyone can travel like a dignitary. Most of us can’t afford to…Read More

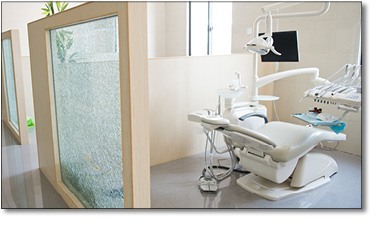

Financial Solutions for Dentists

Running a successful dental practice is physically demanding and very expensive. Graduate school loans, mortgages, equipment loans, book of business buy-outs and property leases can all negatively affect the bottom line of a dental professional. Most general-practice dentists, dental specialists and oral surgeons are holders of multiple bank notes, letters of credit and/or business loans to compensate for expenses above and beyond basic overhead costs.

Running a successful dental practice is physically demanding and very expensive. Graduate school loans, mortgages, equipment loans, book of business buy-outs and property leases can all negatively affect the bottom line of a dental professional. Most general-practice dentists, dental specialists and oral surgeons are holders of multiple bank notes, letters of credit and/or business loans to compensate for expenses above and beyond basic overhead costs.

The lenders of such capital often require financial protection in the form of collateralized insurance – life and disability. The life insurance requirement can be easily addressed by the assignment of benefits of a term product. The disability insurance requirement, on the other hand, poses a more complicated predicament. Read More