Feeling Protected in a Foreign Land is Paramount

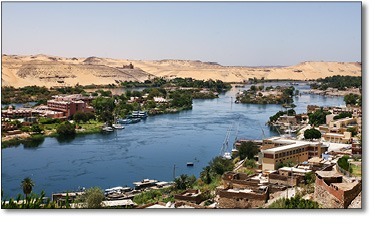

Americans travel the globe for many reasons. Some travel to Karachi to visit family. Many sail the Nile exploring ancient archeological sites. Some of us fly to Sao Paulo for business meetings. Others trek the Himalayas on eco-adventures or vacation in Kenya on safari. Some of us even work in Baghdad guarding the U.S. Embassy. We participate in these endeavors and freely visit or live in these places because we might feel a sense of adventure or nostalgia or even duty. Or we may visit these places simply because there is a welcomed paycheck involved. But those of us who travel to or work in these exotic locales may not be completely aware of how truly dangerous much of the world is.

Americans travel the globe for many reasons. Some travel to Karachi to visit family. Many sail the Nile exploring ancient archeological sites. Some of us fly to Sao Paulo for business meetings. Others trek the Himalayas on eco-adventures or vacation in Kenya on safari. Some of us even work in Baghdad guarding the U.S. Embassy. We participate in these endeavors and freely visit or live in these places because we might feel a sense of adventure or nostalgia or even duty. Or we may visit these places simply because there is a welcomed paycheck involved. But those of us who travel to or work in these exotic locales may not be completely aware of how truly dangerous much of the world is.

Precautions can be taken, but not everyone can travel like a dignitary. Most of us can’t afford to visit foreign countries with an entourage of security personnel. But if we are adventurous enough and lucky enough to see the world, we can do so smartly.

It is strongly recommended to plan and research a location appropriately before embarkation. Be familiar with your destination before you arrive, and utilize resources wisely. Government websites, expat network blogs and American embassies are great sources of travel advice and overseas assistance. Most importantly, be conscious of yourself, your surroundings and those around you, and avoid playing the role of the simple-minded tourist, lost and looking for trouble.

In addition to being self-aware, it is imperative to secure financial protection during your travels. Medical, life, disability and kidnap/ransom insurances are all necessary safeguards for U.S. citizens traveling or living outside the United States. The purchase of these modestly-priced products can save your life and protect your family’s finances.

Petersen International offers a wide range of international-risk insurance plans and options designed to fit any budget and any insurance need for you and your clients anywhere in the world. You’re taking the family to Costa Rica on vacation and need comprehensive travel medical insurance? No problem. A client of yours is moving to Shanghai on a long-term work assignment and needs life insurance? No problem. A journalist friend of yours will be traveling to Kurdistan to do a piece on ISIS and wants kidnap and ransom insurance? No problem.

If you, your loved ones, your clients – if anyone you know are leaving the relative safety and familiarity of the United States, Petersen International is your first and only stop for affordable global financial protection solutions.

For a complete outline of premier international benefits programs, call Petersen International at (800)345-8816.

Financial Solutions for Dentists

Running a successful dental practice is physically demanding and very expensive. Graduate school loans, mortgages, equipment loans, book of business buy-outs and property leases can all negatively affect the bottom line of a dental professional. Most general-practice dentists, dental specialists and oral surgeons are holders of multiple bank notes, letters of credit and/or business loans to compensate for expenses above and beyond basic overhead costs.

Running a successful dental practice is physically demanding and very expensive. Graduate school loans, mortgages, equipment loans, book of business buy-outs and property leases can all negatively affect the bottom line of a dental professional. Most general-practice dentists, dental specialists and oral surgeons are holders of multiple bank notes, letters of credit and/or business loans to compensate for expenses above and beyond basic overhead costs.

The lenders of such capital often require financial protection in the form of collateralized insurance – life and disability. The life insurance requirement can be easily addressed by the assignment of benefits of a term product. The disability insurance requirement, on the other hand, poses a more complicated predicament. Read More

Maryland is Now Open For Business

Petersen International Underwriters is pleased to announce that as of October 1, 2015, high-limit/excess disability insurance can now be filed in the state of Maryland. We are proud to have played a role in the successful passing of Maryland state legislative bill HB565 which is now in effect. The new law allows for the filing of disability insurance through Surplus Lines in the state of Maryland.

Petersen International Underwriters is pleased to announce that as of October 1, 2015, high-limit/excess disability insurance can now be filed in the state of Maryland. We are proud to have played a role in the successful passing of Maryland state legislative bill HB565 which is now in effect. The new law allows for the filing of disability insurance through Surplus Lines in the state of Maryland.

Some time ago, we came to recognize that a severe dilemma needed to be immediately addressed. Millions of Maryland residents have been unable to acquire appropriate levels of income protection insurance through traditional DI carriers. Physicians, attorneys, professional athletes, corporate executives…Read More